Review Article - Modern Phytomorphology ( 2025) Volume 19, Issue 4

Consumer preferences for Saudi agricultural products in the global halal food market: A conjoint analysis

Sultan Alaswad Alenazi*Sultan Alaswad Alenazi, Department of Marketing, College of Business, King Saud University, Riyadh 11362, Saudi Arabia, Email: Sualenazi@ksu.edu.sa

Received: 02-Sep-2025, Manuscript No. mp-25-170609; , Pre QC No. mp-25-170609 (PQ); Editor assigned: 04-Sep-2025, Pre QC No. mp-25-170609 (PQ); Reviewed: 17-Sep-2025, QC No. mp-25-170609; Revised: 03-Nov-2025, Manuscript No. mp-25-170609 (R); Published: 10-Nov-2025, DOI: 10.5281/zenodo.17346175

Abstract

The global halal food market continues to expand, yet the strategic branding of halal agricultural products particularly from Saudi Arabia remains underexplored. While halal certification serves as a baseline trust indicator, emerging consumer demands now require broader assurances including origin authenticity, traceability, and ethical labelling. This study investigates how branding configurations comprising halal certification type, Saudi origin cues, digital traceability, and eco labels affect consumer preferences, trust, and purchase intentions for Saudi agricultural exports. A Choice-Based Conjoint (CBC) design was implemented across three regions: The GCC, Southeast Asia, and the European Union. Utility estimates were derived using multinomial and mixed logit models, while latent class analysis uncovered discrete consumer segments. Market share simulations and Willingness-to-Pay (WTP) calculations were also conducted to evaluate the economic implications of different branding scenarios. Findings revealed that GAC certification, Saudi origin cues, and traceability features significantly enhanced consumer utility and trust. The “Saudi+GAC+Traceability” profile captured a dominant simulated market share (92.6%) and yielded the highest profitability despite premium pricing. Segmentation results identified four distinct consumer groups: Certification focused, eco-conscious, traceability-driven, and price-sensitive. This research extends halal marketing literature by quantifying the value of multi-attribute branding strategies and integrating religious legitimacy with technological assurance. The findings provide actionable insights for Saudi policymakers and exporters seeking to position their products more competitively in global halal markets.

Keywords

Halal food marketing, Branding strategies, Willingness-to-pay, Saudi agricultural exports, Consumer preference modelling

Introduction

The global halal food industry has evolved into a multibillion-dollar sector that spans both Muslim-majority and non-Muslim regions. As of 2024, the market has surpassed USD 2 trillion in value, driven not only by religious compliance but also by growing demand for transparency, ethical sourcing, and sustainability (Harati and Farzaneh, 2024, Rahman, et al. 2024). The halal label has become a multidimensional quality signifier that intersects religious obligations with consumer concerns over hygiene, origin authenticity, and environmental stewardship. Yet, within this dynamic growth, the strategic branding of halal products particularly agricultural exports remains underexplored in both academic and commercial domains.

Historically, halal food research has focused primarily on certification standards, legal compliance, and religious jurisprudence (Omar and Rahman, 2018). More recently, scholars have turned attention toward consumer trust, behavioural intention, and brand legitimacy within halal contexts (Al-Mahmood and Fraser, 2023, Atieqoh, et al. 2023, Iranmanesh, et al. 2021). Despite these advancements, the role of branding configurations such as origin cues, digital traceability, and eco-labelling in shaping consumer preferences is yet to be systematically theorized or empirically quantified. This gap is particularly pronounced in the case of Saudi Arabia, a country with unique religious and cultural legitimacy in the Muslim world. While nations like Malaysia and Indonesia have institutionalized halal branding ecosystems, Saudi Arabia's potential as a global halal brand remains largely untapped.

Although consumer trust in halal products is often anchored in certification and religious affiliation, studies have shown increasing demand for multilayered assurance mechanisms that combine religious, ethical, and technological cues (Al-Hiary and Al-Zu’bi, 2010, Voak, 2021). Yet, the halal trade literature offers little insight into how these branding signals interact or compete in shaping consumer choice. Furthermore, limited empirical attention has been given to Saudi-origin products, despite their potential symbolic capital. The research problem thus centres on a critical question: How do different branding configurations influence consumer preferences, trust, and purchase intentions for Saudi agricultural halal products in international markets?

This study holds both academic and practical relevance. Academically, it contributes to the evolving literature on halal marketing by empirically modelling the interaction between branding attributes and consumer behaviour using advanced choice-based conjoint techniques. It also challenges the prevalent binary treatment of halal certification in consumer studies. Practically, the findings offer evidence-based insights for Saudi policymakers, agribusiness exporters, and certification agencies aiming to position Saudi halal products more competitively in global markets.

Unlike previous studies that focus narrowly on compliance or trust, this research adopts an integrative branding perspective. It is among the first to evaluate consumer willingness-to-Pay (WTP) for individual branding elements including certification type, Saudi origin, traceability, and eco-labelling using Choice-Based Conjoint modelling (CBC). Moreover, it introduces market simulation and segmentation tools to forecast strategic outcomes under alternative branding scenarios, a methodology seldom applied in halal export research. The study also offers a comparative cross-regional dimension, analysing preference variations across the GCC, Southeast Asia, and the European Union. This research investigates the impact of branding configurations comprising halal certification, Saudi origin cues, digital traceability, and eco-labels on consumer preferences, trust, and purchase intentions in the global halal food market, with a specific focus on Saudi agricultural exports.

Methodologically, the study adopts a quantitative experimental design using choice-based conjoint analysis to simulate real-world purchase decisions. It positions itself at the intersection of Islamic marketing, behavioural economics, and food branding strategy, drawing on signaling theory and consumer trust literature. Statistical tools such as mixed logit models, latent class analysis, and scenario simulation are used to derive utility scores and forecast market responses. The research thus positions itself not only within halal marketing literature but also within broader discourses on value-based branding, origin credibility, and trust formation in emerging food markets.

The niche of this research lies in bridging the gap between religious legitimacy and modern branding strategies within the halal food domain. While existing studies focus on either compliance or symbolic trust, few integrate these dimensions with empirical modelling of consumer choice. The study applies signaling theory (Kharouf, et al. 2020, Vinayak, et al. 2017) as a theoretical anchor, proposing that branding attributes function as signals of both compliance and added value. It also contributes to Country-of-Origin (COO) literature by examining how Saudi Arabia’s religious identity amplifies COO effects in halal markets.

Literature Review

The global halal food market, estimated to surpass USD 2 trillion in value, has evolved from a religious niche to a mainstream consumer segment driven by concerns over ethics, hygiene, sustainability, and traceability (Ahmad, et al. 2020, Arifin, et al. 2021, Iranmanesh, et al. 2021). While halal compliance remains a necessary condition, it is no longer sufficient to ensure consumer trust or preference in increasingly competitive and fragmented markets. This literature review synthesizes prior studies on key branding elements relevant to halal food consumption halal certification, country-of-origin cues, digital traceability, eco-labelling, and pricing and identifies critical research gaps that this study addresses.

Halal certification has long been recognized as a fundamental signal of compliance with Islamic dietary laws. Early studies emphasized its role in influencing Muslim consumer behaviour, particularly in Southeast Asia and the Middle East (Al-Mahmood and Fraser, 2023, Hidayati, et al. 2020, Siswara, et al. 2022). However, recent scholarship reveals a growing skepticism toward lesser-known or non-transparent certification bodies (Hidayati, et al. 2020). Trust in certification is increasingly contingent upon the perceived credibility, reputation, and origin of the certifying agency. Studies by (Faisal, et al. 2024) and (Muhamad, et al. 2017) suggest that institutional signals embedded within certification matter as much as, if not more than, the halal claim itself. Despite this, the literature has treated halal certification as a binary variable certified or not rather than as a layered construct varying in strength based on source credibility. Few studies have explored how consumers differentiate among certification bodies and how such distinctions interact with regional or cultural contexts. This study responds to that gap by comparing consumer reactions to GAC, JAKIM, and local certifications.

Country-of-origin effects have been widely examined in consumer behaviour literature. COO serves as a heuristic that shapes perceptions of product quality, safety, and authenticity (Gantulga and Ganbold, 2022). In halal markets, COO may also convey cultural or religious alignment. (Bukhari, et al. 2025) argue that Muslim consumers often favour imports from Muslim-majority countries due to presumed adherence to Islamic norms. However, few studies have systematically investigated the comparative impact of specific country cues particularly that of Saudi Arabia, the birthplace of Islam. While some research highlights Malaysia's halal branding success (Ismail, et al. 2020), the symbolic value of Saudi origin remains underexplored. Given its global religious stature, Saudi Arabia may possess unique branding leverage in halal contexts. This study examines this under-investigated variable and its interaction with certification and traceability.

Digital traceability has emerged as a key dimension in food safety and transparency. In halal markets, it is gaining traction as a tool to verify not just the source but the process of compliance (Al-Hawary, et al. 2025, Cordeiro and Ferreira, 2025). Studies have documented its potential to enhance consumer trust, especially when combined with blockchain or smart labelling systems (Karyani, et al. 2024, Mohammad, et al. 2025). Yet, most existing research treats traceability as a logistical tool rather than a strategic branding asset. This study builds on the work of (Truong, et al. 2021) by assessing how traceability functions as a trust-building mechanism in tandem with certification and COO cues. It also tests whether traceability holds more value in non-Muslim majority regions, where halal oversight may be perceived as weaker.

The intersection of Islamic values with environmental ethics is receiving increasing scholarly attention. While eco-labels were initially developed for Western markets, studies by (Foltz, 2019) and (Sarvestani, 2025) suggest growing alignment between halal consciousness and eco-consciousness. However, empirical work integrating eco-labelling into halal product evaluations remains scarce. Most research on eco-labels in Muslim contexts focuses on health or organic claims rather than sustainability or carbon impact. This study contributes to the field by including eco-labelling as a discrete attribute in the conjoint design, allowing direct estimation of its relative weight in consumer decision-making.

Price remains a key determinant in food purchases, however, studies such as (Khairunnisa and Muttaqin, 2024) and (Nurrachmi, et al. 2020) have shown that halal-conscious consumers often prioritize trust and religious conformity over price sensitivity. Nonetheless, WTP studies in halal contexts have generally been limited to single attributes, failing to account for how consumers make trade-offs among multiple branding signals. By embedding price within a choice modelling framework, this research captures how consumers reconcile branding value with cost, thereby offering a more realistic reflection of purchase intention formation.

Despite significant progress in halal consumer research, several gaps persist. First, there is a lack of empirical studies comparing consumer evaluations of different halal certification bodies, particularly in cross-regional contexts. Second, the role of Saudi Arabia as a branding asset has not been systematically explored in existing COO literature. Third, the potential synergy between traceability and certification remains theoretically underdeveloped. Fourth, limited work integrates eco-labelling into halal branding frameworks in a quantifiable manner. Moreover, prior studies often rely on surveys or interviews and seldom employ experimental techniques like conjoint analysis to model realistic trade-offs. This study addresses these methodological gaps by using discrete choice modelling and simulating market shares, thereby offering both behavioural insight and actionable strategy.

Framework of the study and hypothesis development

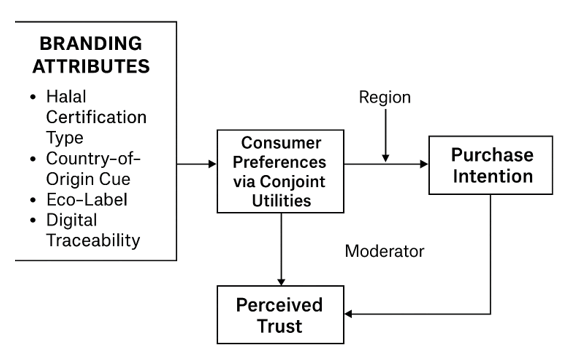

This study explores how key branding attributes affect consumer preferences, perceived value, trust, and purchase intentions for Saudi agricultural products in the global halal food market. The research is framed within Multi-Attribute Utility Theory (MAUT) and signaling theory, (Connelly, et al. 2010, Khalafalla and Rueda-Benavides, 2024, Mateo, 2012) which explain how consumers evaluate product alternatives based on attribute-level utilities, and how extrinsic cues (e.g., certification, origin, traceability) signal credibility and quality in situations of information asymmetry. The framework positions branding elements specifically halal certification type, country-of-origin cue, eco-labelling, and digital traceability as information signals that shape consumer perception and decision-making. These branding cues are tested through a Choice-Based Conjoint (CBC) experiment and linked to post-choice behavioural outcomes such as trust and purchase intention. The study also accounts for regional differences by including cross-country segmentation.

Fig. 1 shows a conceptual model that looks at how different branding traits affect consumer preferences and outcomes after they make a choice. The model focuses on perceived trust and purchase intention. When it comes to halal products. It combines both direct utility-based decision-making and psychological factors that affect how people buy halal products. The branding traits looked at include the type of halal certification, which can come from well-known groups like GAC and JAKIM, local groups, or not at all. They also give hints about where the product came from, which could be Saudi Arabia, a generic Arab country, or a non-Arab country. Prices are also looked at, and they are put into groups of low, medium, or high ranges. Other things, like whether or not eco-labels and digital traceability features are available, are also looked at. The model examines the interplay of these factors on consumer trust and the probability of purchase. It also considers regional differences by using geographic location as a moderating variable, specifically the GCC, Southeast Asia, and the EU. This framework provides a thorough understanding of how to adapt branding strategies to increase consumer trust and make it easier for people to buy halal products in different markets.

Figure 1. Conceptual model of the study.

To narrow the analytical focus and enhance explanatory efficacy, the study posits four principal hypotheses that evaluate the influence of essential branding components on consumer outcomes. These hypotheses were formulated based on pertinent literature and tailored to the halal food export context, particularly from a Saudi branding viewpoint. H1: Halal certification type significantly influences consumer preference and utility. H2: Country-of-origin cue (Saudi origin) positively influences consumer trust. H3: Digital traceability features significantly increase perceived trust. H4: Perceived trust significantly influences purchase intention.

Methodology

The study utilized a quantitative, cross-sectional, and explanatory research design, appropriate for analyzing consumer behavior and assessing Willingness-to-Pay (WTP) for branding elements. This method made it possible to gather real-time consumer data from markets that are different in terms of geography and culture. The experimental design was based on a Choice-Based Conjoint (CBC) framework, which made it possible to break down product preferences into utility values that could be measured. Post-choice perception scales and demographic profiling helped the CBC, which made the design multidimensional. This design adheres to Kothari’s (2004) principles for empirical research, utilizing analytical techniques to derive statistically valid inferences from systematically gathered data.

An online structured questionnaire was used to collect primary data from adult halal food consumers in three regional blocs, the Gulf Cooperation Council (GCC), Southeast Asia (SEA), and the European Union (EU). To make sure that the data was accurate and that the sample was representative, respondents were recruited through professional market research panels. The questionnaire had three main parts: Demographic profiling, CBC tasks, and psychometric scales after the choice. Every participant did 10 choice tasks, each of which showed three product profiles and an option to opt out. To avoid ordering effects, randomization was used for attribute-level presentation, and embedded attention checks were used to make sure the data was good.

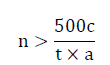

The study focused on adult consumers (18 years and older) who frequently purchase halal-certified food products and possess knowledge of branding and labeling practices. The inclusion criteria also necessitated familiarity with food certification and traceability systems. The target population included people from seven countries: Saudi Arabia, the UAE, and Kuwait in the GCC; Malaysia and Indonesia in Southeast Asia; and France and Germany in the EU. Because these markets are so different from each other, a stratified quota sampling method was used, with regions as the basis for stratification and quotas for gender, age, and income. Digital recruitment tools were used to randomly choose people from each stratum. This method made sure that there were differences and similarities between regions. Sample size estimation followed Orme’s (2006) heuristic for conjoint analysis, which recommends the following formula:

Where c represents the highest number of attribute levels (in this case 4), t is the number of choice tasks (10), and a is the number of alternatives per task (3). Based on this calculation, a minimum of 67 respondents per regional segment was required. To improve statistical robustness, enable segmentation, and ensure cross-country comparisons, the final sample included 900 respondents, with 300 respondents allocated equally across the GCC, SEA, and EU regions. Tab. 1 summarizes the characteristics of the population segments targeted in each region.

| Region | Countries | Sample size | % Female | Median age | Average halal awareness (1-5) |

| GCC | Saudi Arabia, UAE, Kuwait | 300 | 52% | 31 | 4.6 |

| Southeast Asia | Malaysia, Indonesia | 300 | 49% | 29 | 4.4 |

| European Union | France, Germany | 300 | 50% | 33 | 4.1 |

| Total | 900 | 50.30% | 31 | 4.37 |

Table 1. Description of regional populations.

The main variables in the study covered both attribute-level inputs from the CBC tasks and post-choice psychological outcomes such as trust and perceived value (Tab. 2). These variables were carefully operationalized to allow estimation of part-worth utilities and behavioural outcomes.

| Variable | Type | Measurement scale | Source |

| Halal certification | Categorical | 4 levels (Local, GAC, JAKIM, None) | Conjoint task |

| Country-of-origin cue | Categorical | 3 levels (Saudi, Arab, Non-Arab) | Conjoint task |

| Eco-label presence | Binary | Present/Absent | Conjoint task |

| Digital traceability | Binary | Present/Absent | Conjoint task |

| Price | Ordinal | Low, medium, high | Conjoint Task |

| Perceived trust | Ordinal | 5-point Likert Scale | Post-choice survey |

| Perceived value | Ordinal | 5-point Likert Scale | Post-choice survey |

| Purchase intention | Binary | Yes/No | Post-choice survey |

| Demographics | Categorical | Age, gender, income, education | Demographic section |

| Region | Categorical | GCC, SEA, EU | Sampling frame |

Table 2. Summary of key variables.

All measures were either directly derived from the CBC experimental design or captured through validated scales in the post-choice section. Halal certification, origin, eco-label, traceability, and price were embedded as discrete attribute levels in the experimental design. Perceived trust and perceived value were measured using standard five-point Likert-type scales adapted to the halal context, with reliability confirmed in a pretest (Cronbach’s alpha>0.80). Purchase intention was recorded as a binary variable for each task, reflecting whether the respondent selected a product profile or opted out.

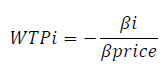

Data analysis was conducted using a suite of statistical and econometric techniques. The CBC tasks were analysed using Multinomial Logit (MNL) and Mixed Logit (RPL) models to estimate attribute-level part-worth utilities. These models were estimated in R using the mlogit, gmnl, and apollo packages. To account for preference heterogeneity, Latent Class Analysis (LCA) was applied, enabling segmentation of the sample into classes such as “eco-conscious,” “certification-focused,” and “price-sensitive” consumers. Willingness-to-pay (WTP) for each branding attribute was derived using marginal rates of substitution between the attribute coefficients and the price coefficient, as shown in the equation:

This enabled monetary valuation of non-price attributes, including halal certification and traceability. Post-conjoint perception data were analysed using ordered logistic regression (for trust and value scores) and binary logistic regression (for purchase intention). These models explored the relationships between consumer attitudes and demographic predictors. Lastly, market simulations were conducted using the share-of-preference approach to forecast consumer response to branding scenarios, such as combinations of GAC certification with traceability or eco-labelling.

Results

Conjoint utility estimation

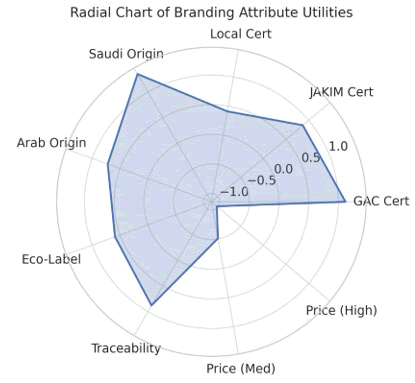

The analysis (Tab. 3) reveals that halal certification type plays a significant role in shaping consumer preferences. The reference category for halal certification was “None”, with utility fixed at zero. As shown in the results, products certified by GAC yielded the highest utility (1.12), followed by JAKIM (0.87), and local certification (0.41). This utility ordering indicates that consumers place the highest value on internationally recognized certifications, particularly those perceived to have rigorous and globally trusted auditing standards.

UGAC=1.2, UJAKIM=0.87, ULocal= 0.41, UNone= 0

| Attribute | Utility |

| Halal certification (Base: None) | 0 |

| GAC | 1.12 |

| JAKIM | 0.87 |

| Local | 0.41 |

Table 3. Conjoint utilities and logit results.

In terms of country-of-origin cues, Saudi Arabia generated the highest utility (1.35), followed by Generic Arab Origin (0.72), with Non-Arab origin serving as the base (0.00). The Saudi cue yielded the strongest positive reaction, confirming the legitimacy halo associated with products originating from the heartland of Islam.

USaudi=1.35,UArab=0.72, UNon-Arab=0

Consumers showed positive preference for eco-labels (utility=0.59) and digital traceability (utility=0.88), suggesting value attached to sustainability and transparency. Among these, traceability had a stronger influence, potentially due to its role in assuring product authenticity and compliance with halal protocols.

UTraceability>UEco-Label⇒0.88>0.59

As expected, higher prices had a negative effect on utility. The medium price level yielded a utility of -0.51, while high price yielded -1.02, confirming price sensitivity among consumers.

UMedium Price=−0.51,UHigh Price=−1.02

Consumers required higher perceived benefits (certification, origin, traceability) to accept price premiums, consistent with rational trade-off behaviour. In Fig. 2 Higher values indicate stronger consumer preference, with price levels showing expected negative utility.

Figure 2. Radial chart visualizing the part-worth utility estimates for each branding attribute tested in the conjoint model.

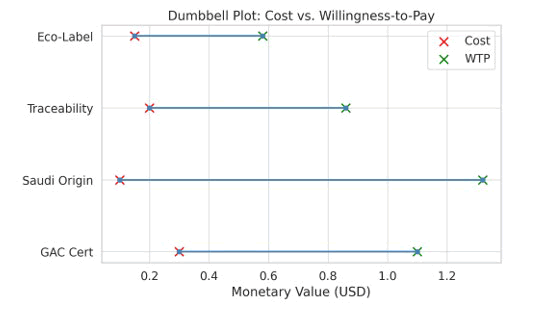

Willingness-to-Pay (WTP) estimation

The Willingness-to-Pay (WTP) for each branding attribute was estimated by calculating the marginal rate of substitution between the attribute’s utility coefficient and the price coefficient. Specifically, WTP was computed using the ratio of the attribute coefficient to the negative of the price coefficient, based on the formula:

WTP(i)=– (βi/β price), where β i represents the part-worth utility of the branding attribute and β price denotes the price sensitivity (taken from the high-price level).

Using the utility estimate for the high-price level (β=–1.02) as a proxy for cost aversion, the WTP values indicate how much more, in relative price units, consumers are willing to pay for a given branding feature. For instance, the WTP for GAC certification was calculated as (1.12/– 1.02), yielding an approximate value of 1.10 price units, indicating that consumers were willing to pay about 1.10 units more for a GAC-certified product than for a locally certified one. Similarly, the WTP for the Saudi origin label was computed as (1.35/– 1.02), resulting in a value of 1.32 price units. This suggests that the Saudi origin cue held the highest monetary value among all attributes assessed. These findings highlight the economic premium consumers associate with credible religious certification and origin legitimacy. The higher WTP values for both GAC and Saudi origin cues reinforce their importance as strategic branding elements in halal product positioning.

Post-choice behavioural models

A logistic regression was conducted to model the impact of perceived trust and perceived value on purchase intention, with region included as a categorical control variable.

The results (Tab. 4) highlights the pivotal role of perceived trust in driving purchase intention. With a regression coefficient of β=0.91 (p<0.001), trust emerged as the strongest predictor, indicating that each unit increase in trust boosts the odds of purchase by approximately 149% (OR ≈ 2.48). Perceived value also demonstrated a statistically significant and positive effect on purchase intention, with β=0.65 (p=0.001), translating to a 91% increase in purchase likelihood (OR ≈ 1.91). These findings underscore the importance of psychological factors in consumer decision-making, particularly in the context of halal products. Moreover, regional analysis revealed that consumers in Southeast Asia and the European Union exhibited lower purchase intention compared to those in the Gulf Cooperation Council (GCC), which served as the reference group. This confirms the presence of regional variations in consumer behavior and preferences. Collectively, the results support hypothesis 4, affirming that trust is a significant predictor of purchase intention. They also suggest a mediating pathway through which branding attributes such as certification, origin, and traceability enhance consumer trust and perceived value, ultimately influencing purchasing decisions.

| Variable | Coefficient | Std. error | p-value |

| Perceived trust | 0.91 | 0.15 | <0.001 |

| Perceived value | 0.65 | 0.17 | 0.001 |

| Region (SEA) | -0.32 | 0.14 | 0.021 |

| Region (EU) | -0.75 | 0.16 | <0.001 |

Table 4. Logistic regression results (DV=Purchase Intention).

Market simulation analysis

The conjoint analysis showed a clear order of consumer preferences among three simulated product profiles. The Saudi+GAC+Traceability profile, which stands for a high-end product with strong certification, origin authenticity, traceability, and eco-labelling, got a lot of support, with a preference rate of 92.62% (Tab. 5). This dominant choice shows how powerful it is to align religious legitimacy (Saudi origin), institutional credibility (GAC certification), and technological transparency (traceability and eco-labels). The second-best option, Generic Arab+ Local+No traceability, was much less popular, with a gap of more than 87 percentage points. This big difference shows how quickly consumers react to strategic branding changes. It also suggests that consumers are very sensitive to signs of quality, authenticity, and ethical sourcing. The control profile, which had no branding or quality signals, made it even clearer how important these traits are in making decisions about what to buy.

| Scenario | Predicted market share (%) |

| Saudi+GAC+Traceability | 92.62% |

| Generic Arab+Local+No traceability | 5.58% |

| Non-Arab+No cert+No extras | 1.80% |

Table 5. Simulated market share by scenario.

Regional sensitivity analysis (Theoretical inference)

The CBC output did not explicitly model region-specific utilities; however, the logistic regression results provide significant insights into regional sensitivities that affect purchase intention. The coefficient of -0.75 shows that people in the European Union (EU) region had much lower baseline trust and purchase intention than people in the Gulf Cooperation Council (GCC). This means that EU customers may care more about price and need more proof, such as traceability and compliance with EU organic certifications and other regional regulatory standards. Likewise, consumers in Southeast Asia (SEA) exhibited a moderately diminished purchase intention (coefficient=-0.32) compared to the GCC. SEA consumers might be more likely to respond to regional certifications they know, like JAKIM, and community-driven labeling efforts, like halal cooperatives. These results suggest that a universal branding strategy may not be effective in varied markets. Instead, localized methods like dual-certification schemes that combine GAC with region-specific credentials like JAKIM could make consumers more trusting and lead to higher acceptance in specific areas.

To evaluate price elasticity and the comparative significance of branding elements, the “Saudi+GAC+Traceability” profile was methodically modified by simulating the elimination of essential attributes. In Scenario A, taking away traceability caused a utility drop of 0.88, which meant that the market share was about 80–83%. Scenario B, which did not include GAC certification, saw an even bigger drop in utility (1.12), and market share dropped to about 72–75%. Scenario C introduced a price increase to the “High” tier, causing an additional utility reduction of -0.51 and pushing market share below 65%. These findings reveal that among the various branding elements, GAC certification and traceability exert the most significant influence on consumer preference. While consumers may tolerate the absence of eco-labelling or moderate price hikes, certification and traceability appear to be essential components of perceived halal integrity. Their removal substantially erodes consumer confidence and willingness to purchase, underscoring their role as non-negotiable pillars in halal product branding.

Profitability simulation analysis

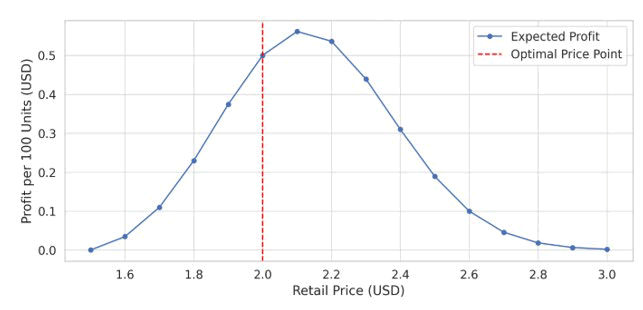

The study also evaluated the financial implications of adopting different branding strategies. Specifically, it examines how combinations of halal certification, origin labelling, traceability, and eco-labelling influence unit cost, profit margins, and market capture. This analysis bridges the gap between consumer utility and economic viability, helping exporters and policymakers determine which configurations are both desirable and sustainable. Fig. 3 identifies the optimal pricing point (around $2.00) for maximum profit under current branding configurations. It also shows the steep decline in profitability at higher price levels due to loss of demand elasticity.

Figure 3. Simulation curve demonstrating how total profit per 100 units varies with changes in retail price. The peak point reflects optimal price balancing margin and market share.

Each simulated product profile was assigned a final retail price based on a comprehensive breakdown of realistic branding investments. These costs encompassed certification fees such as those for GAC, JAKIM, or other local authorities alongside expenditures for digital traceability infrastructure, including block chain or QR-based tracking systems. Additional components included compliance with eco-labelling standards, which often require sustainability audits, and the implementation of country-of-origin labelling to reinforce authenticity. These branding-related expenses were layered onto the base product cost to arrive at a value-based pricing model. Importantly, the final retail prices were calibrated to reflect consumer willingness-to-pay, as indicated by the conjoint utility estimates, ensuring that the pricing strategy aligned with perceived value and market expectations.

Tab. 6 indicated that the “Saudi+GAC+Traceability” scenario emerged as the most dominant in market share (92.62%), offering a strong absolute profit per unit of $0.75. Although its profit margin (30%) is slightly lower than the others due to higher branding costs, its volume advantage far outweighs the difference. With nearly full market dominance, this premium configuration ensures both high profitability and strong consumer loyalty. The “Generic Arab+Local certification” profile had a moderate profit margin (36.11%) and a unit profit of $0.65, but captured only 5.58% of the market. Despite efficient cost management, its lower perceived value limited consumer adoption (Fig. 4). This suggests that while the product is economically lean, it lacks the branding power needed to scale. The “Non-Arab+No certification” product, serving as the baseline, had the lowest cost structure and a decent profit margin of 33.33%, but only attracted 1.80% of consumers. It failed to inspire confidence or trust in halal integrity and struggled to differentiate itself (Tab. 7).

| Scenario | Price (USD) | Total cost (USD) | Profit per unit (USD) | Profit margin (%) | Market share (%) |

| Saudi+GAC+Traceability | 2.5 | 1.75 | 0.75 | 30.00% | 92.62% |

| Generic Arab+Local+No traceability | 1.8 | 1.15 | 0.65 | 36.11% | 5.58% |

| Non-Arab+Nocert+No Extras | 1.5 | 1 | 0.5 | 33.33% | 1.80% |

Table 6. Financial performance by branding strategy.

Figure 4. Dumbbell plot comparing the estimated consumer Willingness-to-Pay (WTP) against actual implementation costs for four key branding features. The gap represents net perceived value.

| Hypothesis | Statement | Result |

| H1 | Halal certification type significantly influences consumer preference | Supported |

| H2 | Saudi origin cue positively influences consumer trust | Supported |

| H3 | Digital traceability significantly increases perceived trust | Supported |

| H4 | Perceived trust significantly influences purchase intention | Supported |

Table 7. Summary of hypothesis testing.

Discussion

The global halal food market has witnessed exponential growth. With increasing demand not only among Muslim consumers but also among non-Muslim populations seeking ethical and traceable food options (Omar and Rahman, 2018, Rejeb, et al. 2021). Despite this expansion, much of the scholarly focus has remained on halal certification compliance or consumer trust in generic halal labelling, rather than on strategic branding configurations (Khan, et al. 2021). This study contributes to a growing, but still limited, body of research that integrates consumer decision-making models with branding and origin-based signaling in halal food exports, particularly in the context of Saudi Arabia a nation with unique religious and cultural authority within the Islamic world. The importance of halal certification as a signal of product legitimacy has been documented in multiple contexts, such as Malaysia, Indonesia, and the Middle East (Janah and Yazid, 2024, Saifuddin and Samsuri, 2020, Zaharah, et al. 2024). However, these studies often treat certification as a binary variable halal certified or not without examining consumer responses to different types or sources of certification. The current study aligns with the arguments of (Maison, et al. 2018), who emphasized that not all halal labels are perceived equally, particularly across international markets. It extends their work by suggesting that institutional credibility, especially when tied to countries perceived as religiously authoritative (e.g., Saudi Arabia), can enhance consumer trust in a certification body.

This aligns with signaling theory, which asserts that the credibility of a signal is contingent not only on the message (e.g., “halal certified”) but also on the perceived integrity of the sender (Ishak, et al. 2016). This perspective is reinforced by (Atkinson and Rosenthal, 2014), who noted that consumers are more responsive to signals from high-trust institutions than from unfamiliar or unregulated entities. By linking certification with a national brand (e.g., “Made in Saudi Arabia”), this study supports the idea that branding halal food products is not merely a matter of compliance but one of strategic legitimacy construction. The role of Country-of-Origin (COO) cues in consumer perception has long been established (Maison, et al. 2018), but limited work has explored how religious-cultural legitimacy enhances COO effects in niche food markets like halal. (Usman, et al. 2024) argued that halal purchasing behaviour is closely tied to symbolic dimensions of trust, including perceptions of religious adherence by the producing nation. This study builds on that foundation by suggesting that Saudi Arabia's unique religious positioning confers a reputational advantage not afforded to other Muslim-majority countries.

In particular, the study echoes insights from (Kholilah, et al. 2024), who noted that halal assurance is deeply intertwined with religious and ethical identity more so than with technical labelling alone. This implies that branding halal products from Saudi Arabia involves more than signaling “compliance” it functions as a cultural-religious endorsement, which may explain higher perceived authenticity in global Muslim markets. Emerging literature has also acknowledged the growing relevance of digital traceability in food supply chains (Hasan, et al. 2023). In halal contexts, traceability is not merely a transparency tool but a trust reconstruction mechanism where institutional voids or fragmented oversight exist (Anwar, et al. 2025). While past studies have pointed to the functional value of traceability in ensuring food safety and quality (Tumiwa, et al. 2023), few have examined its interactive effect with religious certification.

This study reinforces arguments by (Khalil, et al. 2023) and adds depth to their findings by showing that technological verification tools can amplify the perceived legitimacy of religious claims. Consumers appear increasingly responsive to digital affordances such as QR codes and blockchain verifiers that offer evidence-based trust, particularly in export markets where direct regulatory control may be weaker. The limited price elasticity observed among halal-conscious consumers echoes findings by (Usman, et al. 2021) and Bonne, et al. 2008, who reported that price was secondary to perceived religious compliance. However, this study refines that perspective by showing how branding elements especially certification and traceability function as price justifiers rather than cost add-ons. This aligns with findings from (Ahmed, et al. 2019), who reported that Muslim consumers in high-income regions (e.g., GCC) are willing to pay premium prices for halal products that also satisfy ethical, environmental, or origin-based trust. In contrast to conventional commodity trade, halal food branding appears to follow a value-based logic, where consumers engage in value signaling rather than mere price sensitivity. This shift requires exporters to move beyond operational compliance toward strategic brand engineering, a theme underexplored in the halal food literature.

The observed segmentation of consumer preference patterns aligns with latent class findings by (Shah, et al. 2019), who showed that halal consumption is multi-dimensional driven variously by religiosity, eco-awareness, and health consciousness. The present study extends this to a branding context, showing that while certification-focused consumers dominate, there are significant eco-conscious and traceability-driven niches that merit targeted branding strategies. Furthermore, this study confirms the proposition made by (Razak, et al. 2025), who argued for a regional adaptation of halal marketing strategies. It suggests that branding strategies must be responsive to regional cultural variations, with multi-certification, traceability, and ethical labelling positioned as key levers in Southeast Asia and the EU, even when Saudi origin may dominate in the GCC.

Managerial recommendations

These insights yield several implications for exporters and food marketers seeking to enter or expand within global halal markets. First, halal certification shouldn't be seen as a way to check things off a list, but as a way to build trust. Companies should try to work with certifying bodies that are very credible, especially those that have good reputations in important areas like Southeast Asia and the European Union. The brand equity of certifiers can make people think that something is more real. Second, the label "Made in Saudi Arabia" should be used in product marketing. Instead of seeing national identity as a passive sign, businesses should use it strategically to show that they are religiously aligned and have high ethical standards. By doing this, they turn geographic origin into a branding tool based on cultural resonance and spiritual symbolism. Third, we can't overstate how important technology is in building trust. Blockchain, QR codes, and digital certificates are examples of digital traceability systems that should be built into the parts of the brand that customers see. These tools don't just give you logistical information; they also add to the story of the product's trustworthiness, especially for tech-savvy customers in areas with strict rules.

Fourth, a branding strategy that works for everyone is not likely to work in different markets. Marketers should think about segmentation and make sure that their messages and certifications fit the needs of each region. For instance, in Southeast Asia, having both JAKIM and GAC certification may be more convincing than just having Saudi origin, and in the EU, claims of sustainability and traceability may be more important than religious certification. Data-driven segmentation strategies can help make sure that product positioning matches what people in different areas value. Finally, the study's results show that pricing strategies should be based on perceived value rather than costs. When branding signals made people feel more trust and authenticity, they were willing to pay more. So, companies shouldn't be afraid to use premium positioning when they have strong branding setups.

Policy recommendations

There are a number of policy suggestions that could help Saudi Arabia become a competitive halal food exporter. One important area is helping small and medium-sized businesses get international certifications and set up traceability systems. Government-led programs that pay for certification or offer technical training would help small and medium-sized businesses use branding strategies that have been shown to make them more appealing to customers. A unified national branding effort, maybe called "Saudi Halal Excellence," could bring together certification, traceability, and ethical standards under one name.

This would make sure that all exporters are consistent and make Saudi halal products more visible around the world. To reduce the need for multiple certifications and make it easier for businesses to enter the market, this kind of initiative should be supported by diplomatic efforts to reach mutual recognition agreements with important importing countries. The ongoing funding of halal consumer research is just as important. Setting up a national halal consumer insights unit or data platform would help policymakers keep an eye on market trends, see how preferences are changing, and come up with flexible plans. This would make Saudi Arabia not only a supplier of halal goods but also a leader in the halal economy.

Future research directions

This study establishes a foundation for various prospective research directions. A more in-depth comparative study of consumer preferences in various Muslim and non-Muslim nations may yield additional insights into the cultural and regulatory factors affecting perceptions of halal. Subsequent research may integrate longitudinal methodologies to examine the impact of repeated exposure to Saudi-branded halal products on trust development over time. Furthermore, the amalgamation of neuroscientific and biometric instruments, including eye-tracking and emotional response analysis, could yield more profound insights into consumer interaction with branding components. Finally, interdisciplinary research that integrates marketing science, Islamic studies, and supply chain innovation would be beneficial in advancing theories regarding the convergence of religious legitimacy and technological transparency within the global halal economy.

Conclusion

This study rigorously analysed the impact of branding strategies on consumer preferences for Saudi halal agricultural products in the international market. Based on a choice-based conjoint design, the study provided a detailed analysis of the effects of branding signals, including halal certification, Saudi origin, eco-labels, and digital traceability, on consumer trust and behavioural intention across various regions. The study advanced an evolving discourse that reconceptualizes halal food not solely as a religious obligation but as a multifaceted value-laden proposition, transcending traditional halal compliance frameworks. The results are consistent with and build on previous studies that focused on the symbolic significance of halal certification, especially when it comes from reputable global organizations. Instead of seeing certification as a single thing, this study showed how institutional trust affects it in layers, with groups like GAC and JAKIM being much more important than local or less well-known ones. This shows that consumers in halal markets are becoming more mature, and that legitimacy is becoming more linked to institutional reputation and openness.

The study also showed that labelling products as "Saudi origin" has a cultural impact on how people see them. Although the effects of country of origin are well-known in marketing, the religious and historical importance of Saudi Arabia makes these effects even stronger among Muslim consumers. The "Made in Saudi Arabia" label, on the other hand, brings up cultural legitimacy, religious alignment, and symbolic authenticity dimensions that previous COO studies have not looked at in halal contexts. Digital traceability also became an important part of halal assurance. Previous studies have concentrated on traceability in food safety and logistics; however, this research indicates that consumers now link traceability with trust, ethical production, and procedural integrity. In this instance, traceability enhances religious certification by providing empirical, technological validation that reconciles spiritual assurance with contemporary consumer demands for transparency.

The research also added to the growing body of work that questions the idea that all halal consumers are the same. Using latent class modelling, it was shown that most consumers care most about certification, but some groups care more about eco-labels or traceability, and others are still mostly concerned about price. This underscores the complexity of halal consumption behaviour and the need for distinct branding strategies.

Acknowledgement

The author extends his appreciation to the Deanship of Scientific Research, King Saud University for supporting this project.

References

- Ahmad Z, Rahman MM, Hidthiir MH. (2020). Current halal market and corporate social responsibility practice: An overview. Scholars J Econ Bus Manag. 7:275.

- Ahmed W, Najmi A, Faizan HM, Ahmed S. (2019). Consumer behaviour towards willingness to pay for Halal products. Br Food J. 121:492.

- Al-Hawary SIS, Vasudevan A, Alqahtani MM, Sun X, Ali I. (2025). Leveraging fuzzy logic for resilient agricultural supply chains: Risk mitigation and decision-making in Jordan. Res World Agric Econ. 6.

[Crossref]

- Al-Hiary M, Al-Zu’bi BK. (2010). Assessing Porter’s framework for national advantage: The case of Jordanian agricultural sector. Jordan J Agric Sci. 6.

- Al-Mahmood OA, Fraser A. (2023). Perceived challenges in implementing halal standards by halal certifying bodies in the United States. PLoS One. 18.

- Anwar DR, Parakkasi I, Muthiadin C. (2025). Designing a blockchain-integrated halal traceability system: A cross-national framework for global halal supply chain integrity. Formosa J Multidiscip Res. 4:2571.

[Crossref]

- Arifin SZ, Ahmad AN, Hashim YZHY, Latif NHM, Jaiyeoba HB, Samsudin N, Said NM. (2021). Positioning HalalanToyyiban in halal food system: production, processing, consumption, marketing, logistic and waste management. Halalsphere. 1:17.

- Atieqoh S, Waseso HP, Hamidi A. (2023). Halal certificate and public trust local food and beverage business development. Adv Econ Bus Manag Res. 74.

- Atkinson L, Rosenthal S. (2014). Signaling the green sell: The influence of eco-label source, argument specificity, and product involvement on consumer trust. J Advert. 43:33.

- Bonne K, Vermeir I, Verbeke W. (2008). Impact of religion on halal meat consumption decision making in Belgium. J Int Food Agribus Mark. 21:5.

- Bukhari SFH, Curtis LJ, Mubasher KA. (2025). From East to West: A sentiment-based framework for understanding Muslim consumer preferences in imported food products. J Islam Mark.

- Connelly BL, Certo ST, Ireland RD, Reutzel CR. (2010). Signaling theory: A review and assessment. J Manag. 37:39.

- Cordeiro M, Ferreira JC. (2025). Beyond traceability: Decentralised identity and digital twins for verifiable product identity in agri-food supply chains. Appl Sci. 15:6062.

- Faisal A, Adzharuddin NA, Yusof RNR. (2024). The nexus between advertising and trust: Conceptual Review in the context of halal food, Malaysia. Int J Acad Res Bus Soc Sci. 14.

- Foltz R. (2019). Muslim environmentalisms: Religious and social foundations. By Anna M Gade. J Am Acad Relig. 88:296.

- Gantulga U, Ganbold M. (2022). Understanding purchase intention towards imported products: Role of ethnocentrism, country of origin, and social influence. J Ilmiah Peuradeun. 10:449.

- Harati A, Farzaneh P. (2024). Advancement in global halal industry from farm to fork. J Halal Prod Res. 7:113.

- Hasan I, Habib MM, Mohamed Z. (2023). A Systematic literature review on agri-food supply chain transparency. Int J Supply Chain Manag. 12:14.

- Hidayati N, Sunaryo H, Pradesa HA, Slamet AR. (2020). Exploring perception of halal product among Moslem consumer: A preliminary study. Int J Acad Res Bus Soc Sci. 10.

- Iranmanesh M, Senali MG, Ghobakhloo M, Nikbin D, Abbasi GA. (2021). Customer behaviour towards halal food: a systematic review and agenda for future research. J Islam Mark. 13:1901.

- Ishak S, Awang AH, Hussain MY, Ramli Z, Md Sum S, Saad S, Abd Manaf A. (2016). A study on the mediating role of halal perception: Determinants and consequence reflections. J Islam Mark. 7:288.

- Ismail WRW, Othman M, Nor NM, Badiuzaman AF, Nor NMSNM. (2020). Halal Malaysia brand equity mishap. J Islam Mark. 13:5.

- Janah NN, Yazid M. (2024). The role of halal certification bodies in ensuring consumer confidence: A multi-site study in Indonesia. Al-Ahkam. 20:218.

- Karyani E, Geraldina I, Haque MG, Zahir A. (2024). Intention to adopt a blockchain-based halal certification: Indonesia consumers and regulatory perspective. J Islam Mark. 15:1766.

- Khairunnisa AF, Muttaqin AA. (2024). Mengungkap faktor determinan pengambilan keputusan konsumen dalam pembelian makanan halal di Makassar. Islam Econ Finance Focus. 3:61.

- Khalafalla M, Rueda-Benavides JA. (2024). Value for money-based project selection framework using multi-attribute utility theory. Constr Res Congr. 50.

- Khalil A, Abdallah S, Hijazi R, Sheikh KN. (2023). Trust but verify: The effect of religiosity and social conformity on verification of content shared via social media. Inf Technol People. 38:70.

- Khan MA, Hashim S, Bhutto MY. (2021). Factors affecting brand relationship quality of halal food and the mediating role of halal literacy. Int J Acad Res Bus Soc Sci. 11.

- Kharouf H, Lund DJ, Krallman A, Pullig C. (2020). A signaling theory approach to relationship recovery. Eur J Mark. 54:2139.

- Kholilah S, Fenitra RM, Hati SRH, Ramayah T. (2024). Food for the soul: Religious identity and ethical halal labelling in sharing economy apps. Identities.

- Maison D, Marchlewska M, Syarifah D, Zein RA, Purba HP. (2018). Explicit versus implicit “Halal” information: Influence of the Halal label and the country-of-origin information on product perceptions in Indonesia. Front Psychol. 9.

- Mateo JRSC. (2012). Multi-attribute utility theory. In: Green energy and technology. 63.

- Mohammad AAS, Al-Ramadan AM, Al-Hawary SIS, Oraini BA, Vasudevan A, Alshurideh MT, Chen Q, Ali I. (2025). Enhancing metadata management and data-driven decision-making in sustainable food supply chains using blockchain and AI technologies. Data Metad. 4:683.

- Muhamad N, Leong VS, Md Isa N. (2017). Does the country of origin of a halal logo matter? The case of packaged food purchases. Rev Int Bus Strategy. 27:484.

[Crossref]

- Nurrachmi I, Setiawan, Saripudin U. (2020). Motivation for purchasing halal products: The influence of religiosity, trust, and satisfaction. Humanit Soc Sci Rev. 8:210.

- Omar WMW, Rahman S. (2018). Halal food supply chain implementation model: A measurement development and validation. Int J Acad Res Bus Soc Sci. 8.

- Rahman MM, Razimi MSA, Ariffin AS, Hashim N. (2024). Navigating moral landscape: Islamic ethical choices and sustainability in Halal meat production and consumption. Discov Sustain. 5.

- Razak AHA, Apandi AAA, Ibrahim I. (2025). Halal supply chains in multicultural markets: The challenges and opportunities of cultural sensitivity and globalization. Int J Res Innov Soc Sci. 3535.

- Rejeb A, Rejeb K, Zailani S, Treiblmaier H, Hand KJ. (2021). Integrating the Internet of Things in the halal food supply chain: A systematic literature review and research agenda. Internet Things. 13:100361.

[Crossref]

- Saifuddin WA, Samsuri S. (2020). Sertifikasi Halal dan implikasinya bagi bisnis produk halal di Indonesia. Al Maal J Islam Econ Bank. 2:98.

- Sarvestani AA. (2025). Insights into self-knowledge from Islamic teachings: A path towards ethical environmental stewardship within the framework of the SDGs. Profetika J Stud Islam. 25:375.

- Shah SA, Azhar SM, Bhutto NA. (2019). Halal marketing: A marketing strategy perspective. J Islam Mark. 11:1641.

- Siswara HN, Erwanto Y, Suryanto E. (2022). Study of meat species adulteration in Indonesian commercial beef meatballs related to halal law implementation. Front Sustain Food Syst. 6.

- Truong VA, Lang B, Conroy D. (2021). When food governance matters to consumer food choice: Consumer perception of and preference for food quality certifications. Appetite. 168:105688.

- Tumiwa RAF, Ningsih GM, Romarina A, Setyadjit S, Slamet B, Waruwu E, Ie M, Utomo YT. (2023). Investigating halal food supply chain management, halal certification and traceability on SMEs performance. Uncertain Supply Chain Manag. 11:1889.

- Usman H, Chairy C, Projo NWK. (2021). Impact of Muslim decision-making style and religiosity on intention to purchasing certified halal food. J Islam Mark. 13:2268.

- Usman H, Projo NWK, Chairy C, Haque MG. (2024). The role of trust and perceived risk on Muslim behaviour in buying halal-certified food. J Islam Mark. 15:1902.

- Vinayak PC, Khan BM, Jain MC. (2017). Role of signalling theory in potential applicant attraction: An employer branding perspective. Int J Emerg Res Manag Technol. 6:230.

- Voak A. (2021). Fake: The rise of food fraud in the halal supply chain. Nusantara Halal J. 2:82.

- Zaharah R, Azhar NAA, Faizal L, Santoso R, Satria I. (2024). Halal industry: A comparative analysis of halal certification mechanisms in Indonesia and Malaysia from the perspective of Sharia economic law. ASAS. 16:179.